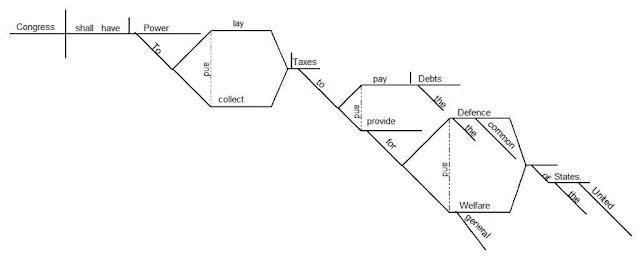

[The] Congress shall have Power To lay and collect Taxes, [Duties, Imposts and Excises,] to pay the Debts and provide for the common Defence and general Welfare of the United States.The omitted words are in square brackets [], omitted because they don't contribute much to analysis of the sentence structure, and to keep the size of the diagram small enough (990x480).

The key points are that "to pay and provide" don't modify "Power", but "Taxes", and "for Defense and general Welfare" modify "provide". Each modifying phrase restricts the word it modifies.

The tricky part of the analysis is to recognize that there is a phrase "to be spent" omitted after "Taxes". In the legal jargon of 1787 a tax was almost always raised to be spent for something that was typically specified when the tax was authorized.

To reach the interpretation some seek to give to the Clause, "to pay and provide" would have to modify "Power", and the Clause would have to insert the word "and":

[The] Congress shall have Power To lay and collect Taxes, [Duties, Imposts and Excises,] and to pay the Debts and provide for the common Defence and general Welfare of the United States.The lack of the "and" after "Taxes" is critical, and it shows that "for common Defence and General Welfare" are a restriction on spending, not a delegated power unto themselves.

At the time the Constitution was written, "general" meant "not specific or special", and that "general" is a restriction on "Welfare" makes the Clause a directive that taxes and spending not be done for the benefit of some parts of the country at the expense of others. It was a bar to intentional redistribution.

That interpretation is further emphasized by the second clause in the sentence:

but all Duties, Imposts and Excises shall be uniform throughout the United States;The diagram

Joseph Story analysis

Supreme Court Justice Justice Joseph Story, Book III, Chapter 14, of his Commentaries on the Constitution of the United States (1833), explains the clause:

§ 904. Before proceeding to consider the nature and extent of the power conferred by this clause, and the reasons, on which it is founded, it seems necessary to settle the grammatical construction of the clause, and to ascertain its true reading. Do the words, "to lay and collect taxes, duties, imposts, and excises," constitute a distinct, substantial power; and the words, "to pay debts and provide for the common defence, and general welfare of the United States," constitute another distinct and substantial power? Or are the latter words connected with the former, so as to constitute a qualification upon them? This has been a topic of political controversy; and has furnished abundant materials for popular declamation and alarm. If the former be the true interpretation, then it is obvious, that under colour of the generality of the words to "provide for the common defence and general welfare," the government of the United States is, in reality, a government of general and unlimited powers, notwithstanding the subsequent enumeration of specific powers; if the latter be the true construction, then the power of taxation only is given by the clause, and it is limited to objects of a national character, "for the common defence and the general welfare."

§ 905. The former opinion has been maintained by some minds of great ingenuity, and liberality of views. The latter has been the generally received sense of the nation, and seems supported by reasoning at once solid and impregnable. The reading, therefore, which will be maintained in these commentaries, is that, which makes the latter words a qualification of the former; and this will be best illustrated by supplying the words, which are necessarily to be understood in this interpretation. They will then stand thus: "The congress shall have power to lay and collect taxes, duties, imposts, and excises, in order to pay the debts, and to provide for the common defence and general welfare of the United States;" that is, for the purpose of paying the public debts, and providing for the common defence and general welfare of the United States. In this sense, congress has not an unlimited power of taxation; but it is limited to specific objects, -- the payment of the public debts, and providing for the common defence and general welfare. A tax, therefore, laid by congress for neither of these objects, would be unconstitutional, as an excess of its legislative authority. In what manner this is to be ascertained, or decided, will be considered hereafter. At present, the interpretation of the words only is before us; and the reasoning, by which that already suggested has been vindicated, will now be reviewed.

Click on the link for the rest.

Sorry about the ads but we depend on people clicking on them to pay our bills.

No comments:

Post a Comment